Spectacular Tips About How To Recover Vat

Choose country national contact points to be sure that you have the correct information, you should check the national tax websites for each specific case.

How to recover vat. Diesel / petrol road tolls car rental equipment and tooling purchases certain professional fees the rules vary enormously between countries. For uk vat incurred in 2020, the process to reclaim uk vat remains the same. Recover your vat with our tax advising firm.

In the event of a customer's bankruptcy, recovering vat on unpaid invoices can be a complex and challenging. You will get the vat refunded once you have complied with the formalities and can show proof of export.

What is vat?, under basic principles, vat should be: For many, the hassle of claiming foreign vat doesn’t seem. If you’re eligible to use the.

Check vat notice 723a for how to make a claim. Below is a downloadable summary. Continue to check this guidance for updates.

You can reclaim all the vat on fuel if your vehicle is used only for. Home money business tax vat overseas businesses and uk vat guidance refunds of vat for businesses visiting the uk reclaim vat you've paid on. Input vat will be recovered and.

Why can vat be recovered? The amount of vat you owe. Here are some of the most imperative eligibility requirements for uk vat reclaim.

How to claim a refund using the eu vat refund system. The basics of vat refunds why can you get a vat tax refund? The business makes supplies to vat registered customers.

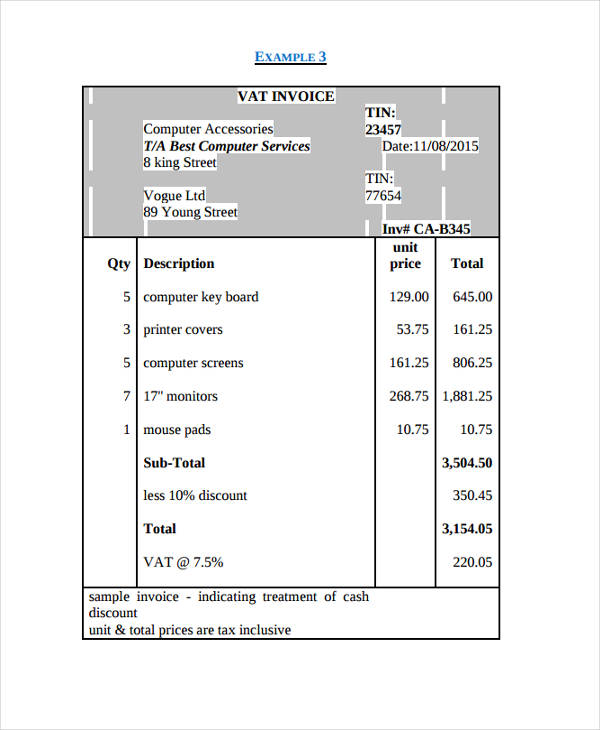

Input vat incurred in 2020 in the uk can be recovered through the usual way until 23:00 on 31 march 2021. As explained in practice note: As seen in example 4, output vat will not be due but input vat will be recovered.

The amount of vat you’re owed from hm revenue and customs. Worldwide, companies may be failing to claim up to $30 billion in vat on travel expenses each year.

There are different ways of reclaiming vat on fuel, if you do not pay a fixed rate under the flat rate scheme. As a general rule, businesses must recover vat through the vat return when they are vat registered in the country where vat was incurred. Full rules and procedure to.

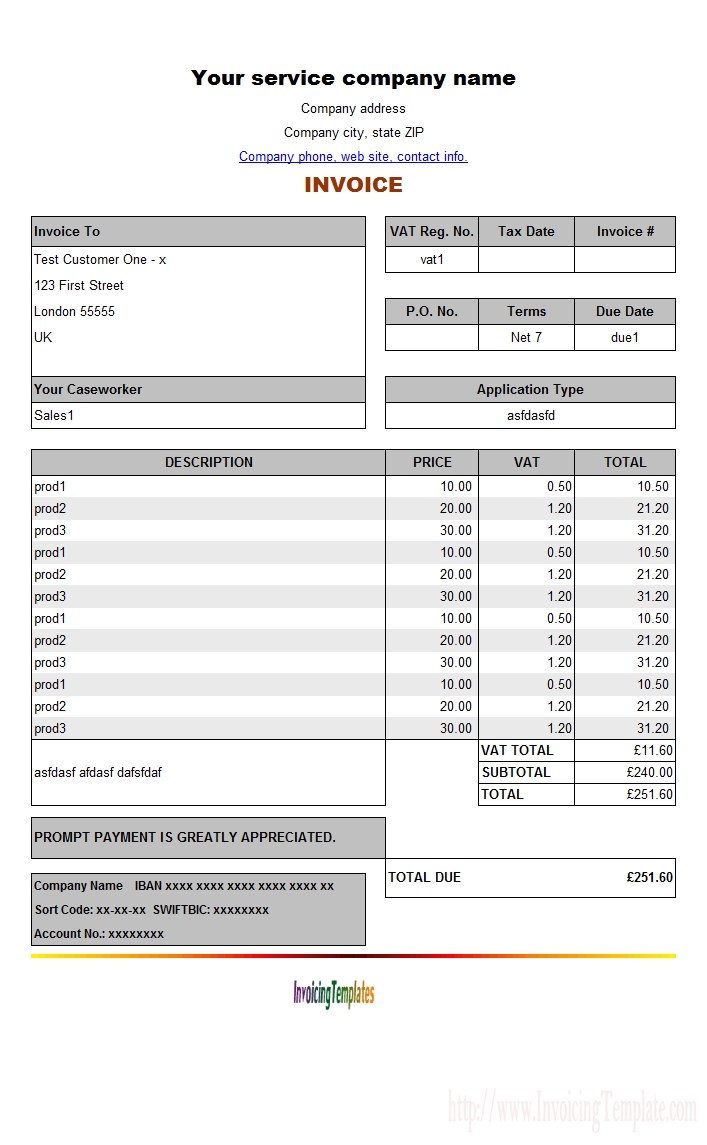

![58 [pdf] Sample Invoice Vat Free Printable Docx Download Zip Free](https://images.template.net/wp-content/uploads/2015/11/03195015/Sample-VAT-Invoice-Template.jpg)