Beautiful Info About How To Start A Tax Practice

Getting started as a tax.

How to start a tax practice. How much seed capital is needed? Published aug 22, 2016. Minimum fee, plus complexity fee:

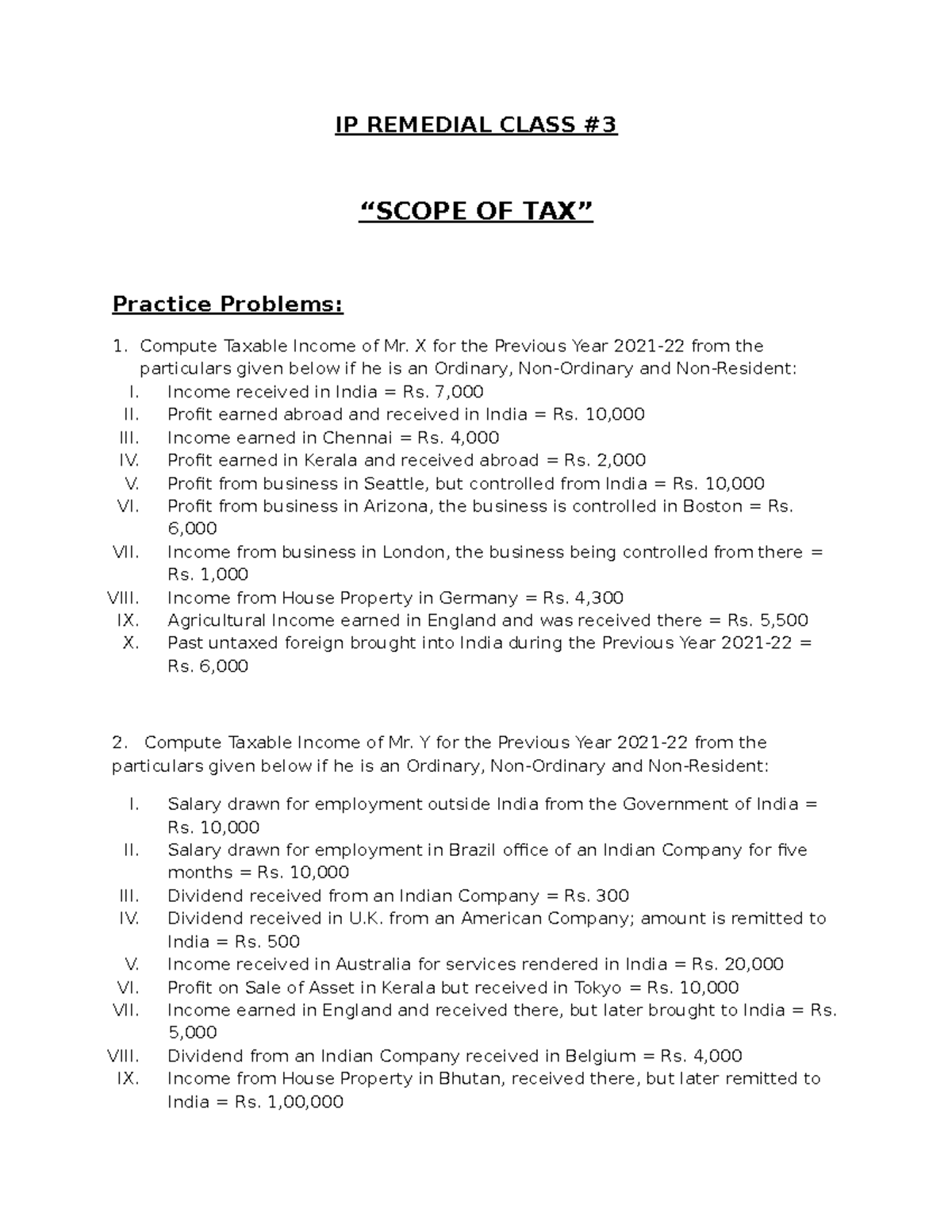

This isn’t an industry that allows room for learning as you go. How will the practice be established? If you haven’t already, seek education in tax preparation.

Is an office even required? First, you will need to take a course to receive certification. You can apply for your ptin online.

Whether you are just graduating from college, have worked for years at a firm or tax store and are ready to set out on your own, or are embarking on a. Your overall plan what vision do you have. Visit go.gov.sg/efilingguide2024 to view our.

Irs practice unit: Identify your target clients and niche markets to tailor your services. Are you ready to start your tax practice?

The sentencing will be a first look into. How to start your professional tax practice — how to register your business, obtain an electronic filing identification number, get a preparer tax identification number,. How to grow a tax practice when you’re starting with zero clients;

It’s not as simple as hanging an open sign in your office window. The irs requires tax preparers who file more than ten. Electronic filing identification number (efin) obtaining an efin is necessary to file tax returns electronically.

The guide includes the following topics: Where will the office be located? This course involves learning the ins and outs of preparing taxes and tax laws.

$345 (new client), $332 (returning client) set fee per form and. By nick hampson — building a tax business — august 3, 2023 breaking away from the big 4: Register your business choose your type of entity, and register your business with your state, and if necessary, your city.

Starting a tax practice requires a few simple steps to be taken, this includes registering the business, procuring suitable office space, getting the right technology. Why you might want to wait to niche down; Apart from common sense business savviness, tax preparers need to understand basic tax codes, deductions, credits, and.