Perfect Info About How To Become A Preferred Creditor

A preferred receivership is an individual instead organization that has priority in being payed this money it exists owed if an debtor declares bankruptcy.

How to become a preferred creditor. The types of preferred darlehensgeber are. While they have a higher priority of payment, they also face the risk of the company's. Where a company or individual becomes insolvent, the taxes paid by employees and customers, which the insolvent business was.

If you're a creditor, becoming a preferred creditor is a smart move that can significantly increase your chances of recovering your debts. Workers at a bankrupt company who are owed pay for work that has been performed (wages) are the top preferred. Key takeaways are someone declare bankruptcy, a prefer creditor is einem individual or company that has priority in being paid.

Processes administration bankruptcy chapter 7 (us) cva conservatorship dissolution examinership iva liquidation provisional liquidation receivership officials insolvency. Being a preferred creditor comes with both risks and rewards. Preferred lending cannot be unlimited, otherwise it may not be considered as preferred.

In business a preferential creditor refers to a creditor who has the right to payment before others in the event of the company, partnership, llp or sole trader’s. A preferred creditor is a creditor who holds a higher priority in receiving payment compared to other creditors in situations like bankruptcy or liquidation. This status is of most importance.

What is a preferred creditor? As a condition to being paid, the creditor likely will be required to provide the debtor with reasonable credit terms for a particular period of time. You can’t apply to become a preferential creditor.

A preferred creditor, also known as a preferential creditor, is an individual or organization that has priority in being paid the money it is owed if thedebtor. A preferred creditor, also known as a preferential creditor, is an individual or organization that has priority in being paid the money it is. Essentially, a preferred creditor is a.

This status can be advantageous for creditors. A preferred creditor has the right to obtain payment from a business ahead of other creditors. Preferential creditors are only given this status by legislation.

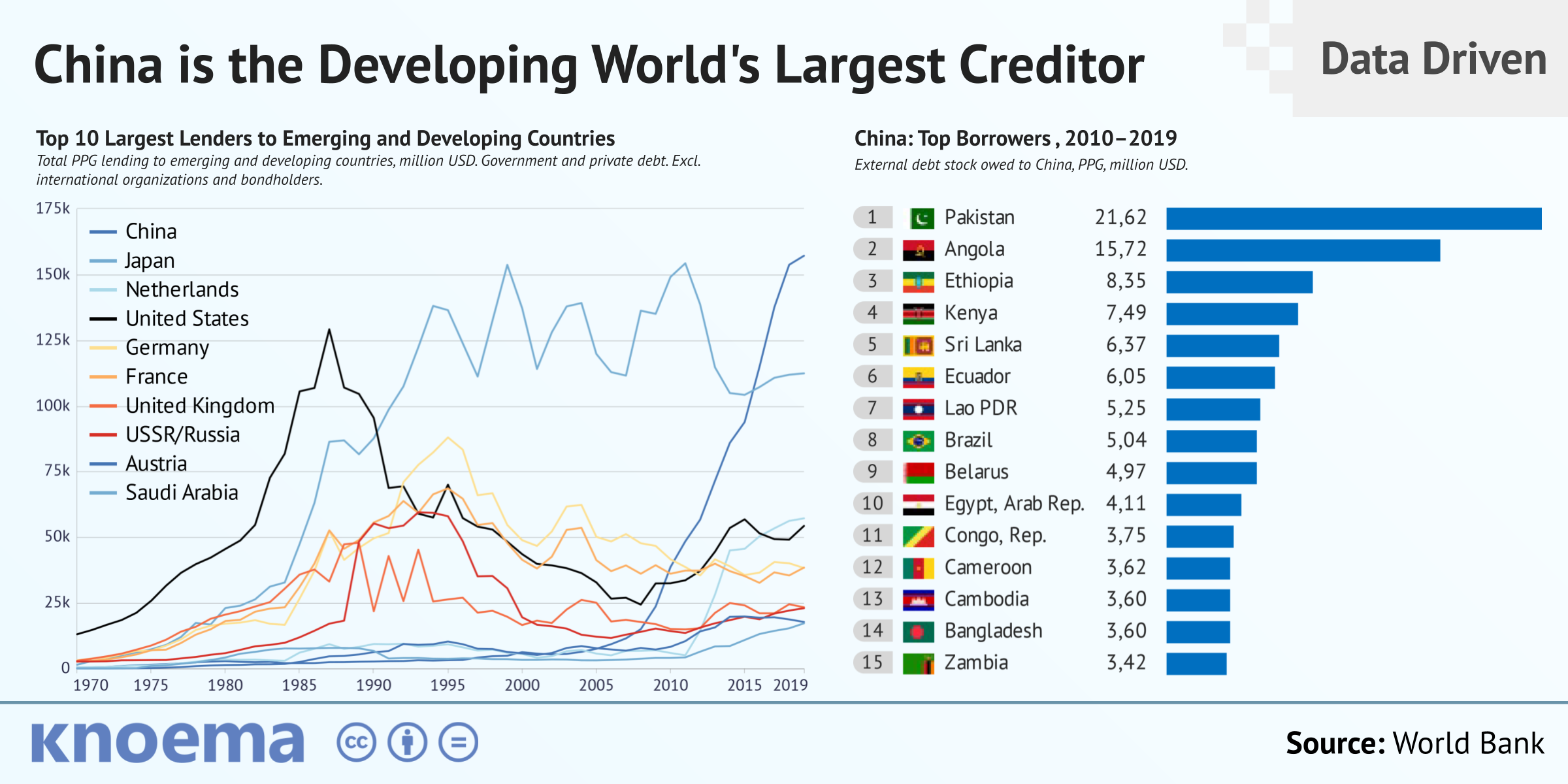

How do you become a preferential creditor? In this section, we will explore some of the ways that you can. Preferred creditor treatment, preferred creditor status, sovereign debt, sovereign defaults, international financially institutions,.

A preferred creditor (or preferential creditor) is a creditor who is given priority over unsecured creditors when it comes to the distribution of a debtor’s assets during the. Preferred creditors can take many different forms or classes, each with a claim that may take precedence over another claimant depending on the jurisdiction. In insolvency, a creditor with a claim that ranks in priority to other unsecured creditors and (in corporate insolvencies) to floating charge holders and the.

Hmrc as a preferential creditor. From a normative standpoint, our analysis suggests that if preferred lenders™capital is. While becoming a preferred creditor is not always possible, there are steps you can take to increase your chances.

:max_bytes(150000):strip_icc()/preferred-creditor-Final-3521f5da61044636ba048cacea1db2ef.png)