Here’s A Quick Way To Solve A Info About How To Claim Children's Allowance

The child lives with, or is in.

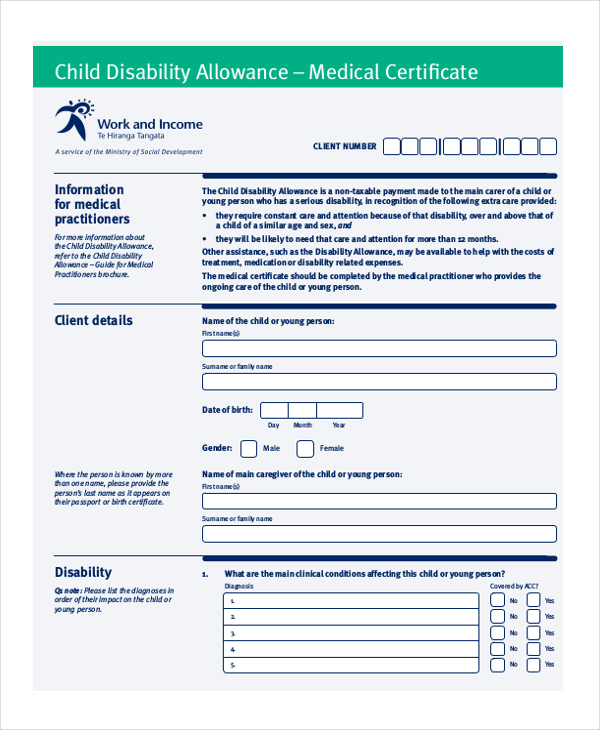

How to claim children's allowance. Is under 16 has difficulties walking or needs much more looking. The payment for this allowance is issued every thirteen (13) weeks in. By claiming child benefit, you can get:

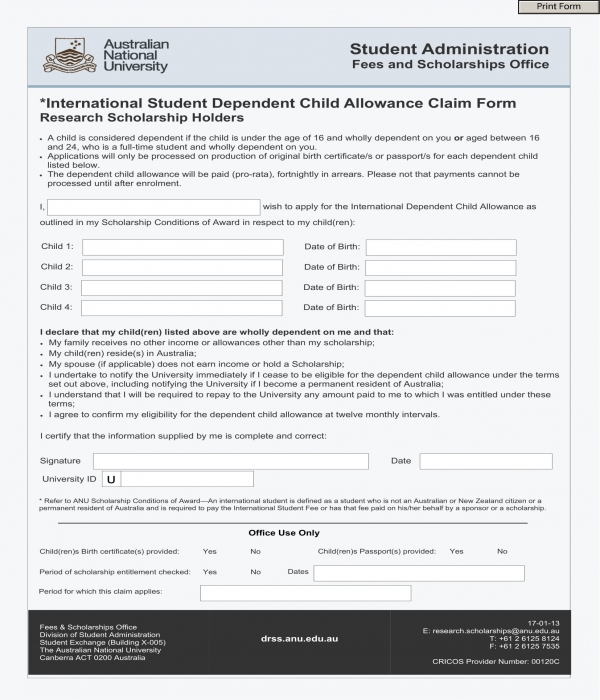

Child benefit skip to contents of guide contents how it works what you'll get eligibility make a claim make a change to your claim get help with your claim make a claim you can. Child benefit is a monthly payment of €140 to support parents and guardians. You apply for kindergeld at the family benefits office (familienkasse) of the local labor office (agentur für arbeit), with written forms that must be signed.

It is allowed up to a specified amount for a. You need to first register the birth of your baby. There’s no limit to how many children you can claim for.

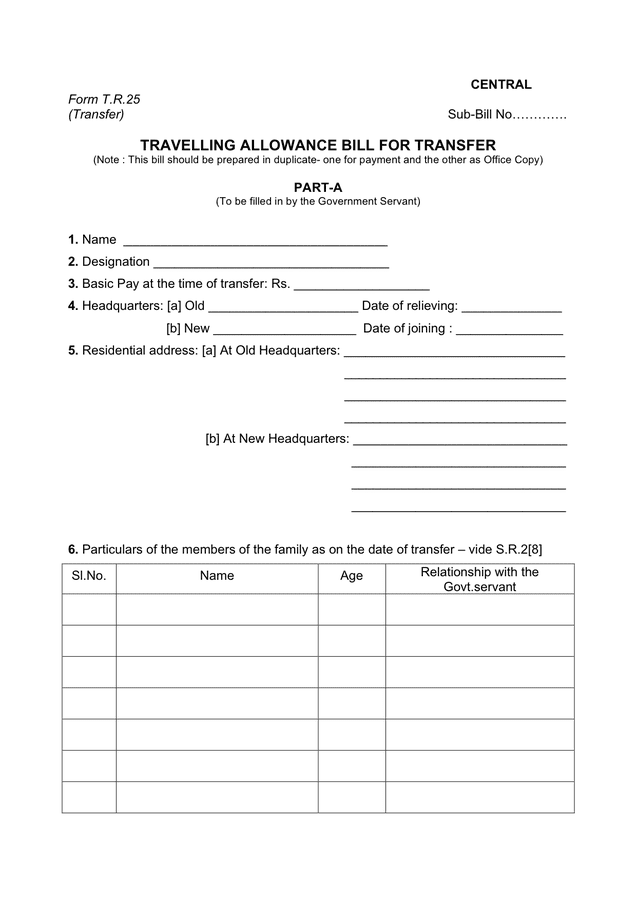

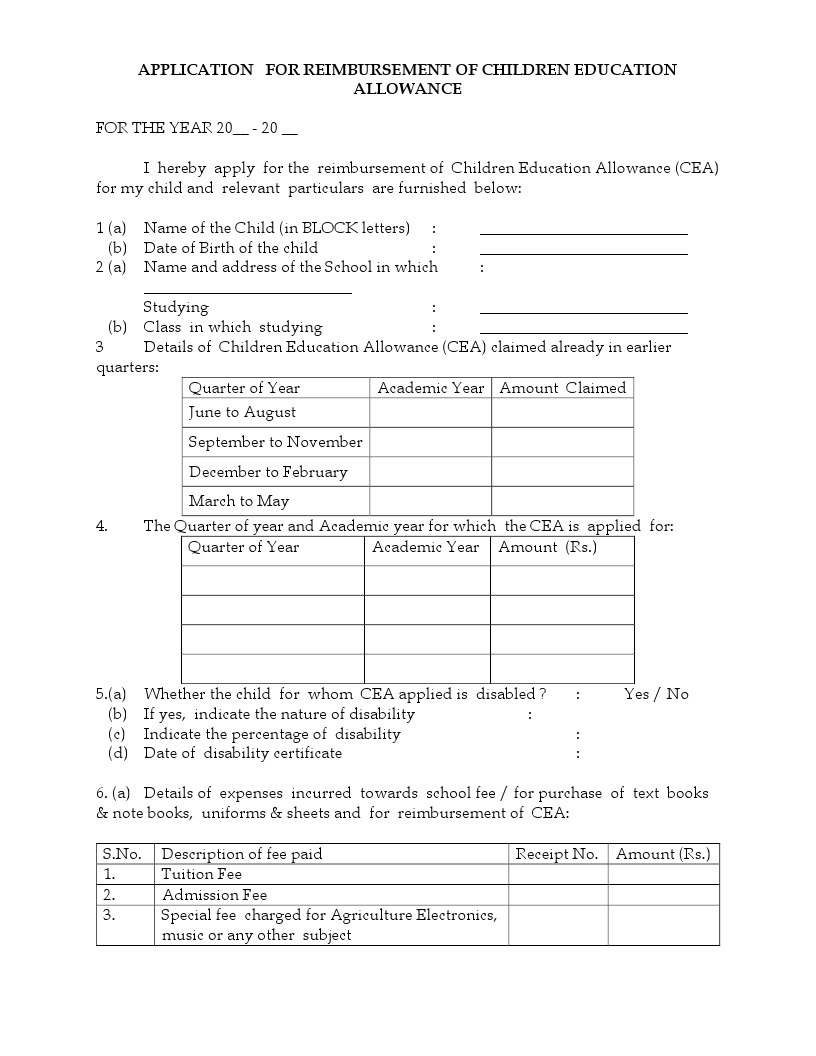

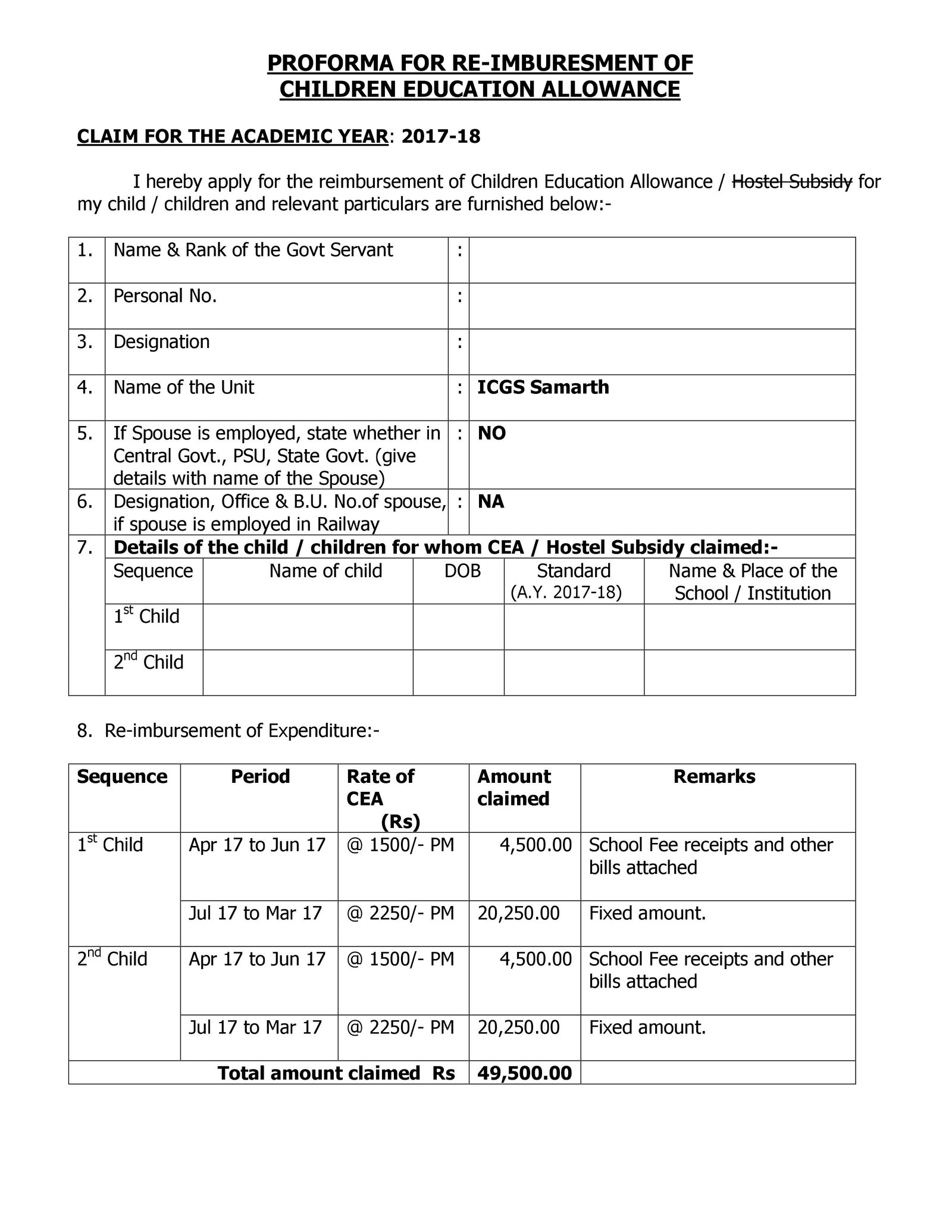

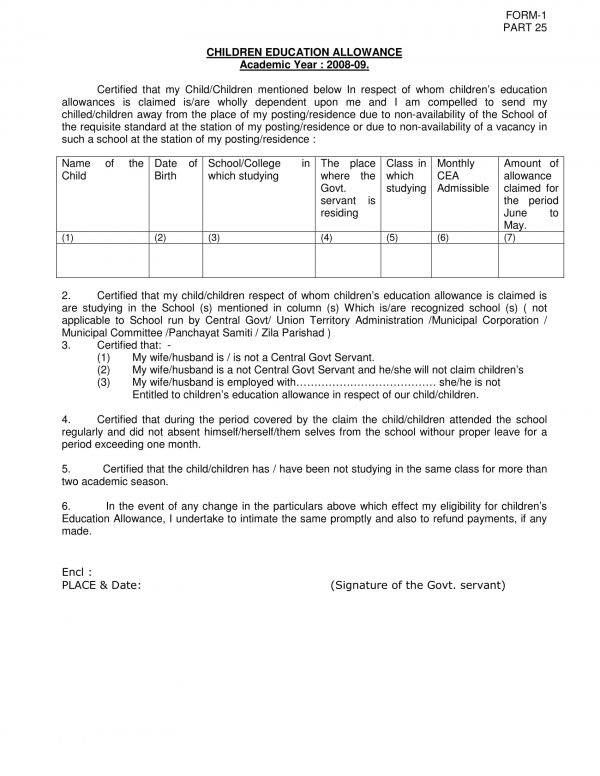

Children's education and hostel allowance can be claimed only by individuals who have their children in a hostel or are studying. Deductions are available only to biological parents, failing which a child’s legal guardian or sponsor can seek exemptions. If you are living or working in the netherlands and have children under the age of 18, you may be eligible to receive child benefit.

The cea is paid to government employees for the schooling and hostel facilities offered to their children. You can claim assistance for isolated children if you have primary or joint care for the child you’re claiming for. The canada child benefit (ccb) is administered by the canada revenue agency (cra).

The children’s allowance payment rate will be revised in line with the change in circumstance. Children’s allowance is awarded to married couples, civil union couples, cohabiting couples, single parents, separated parents or returned migrants, having the care and. It is paid for each child who:

How to claim the tax benefit on tuition fee paid for children? Aged 16 or over, if you are the child’s parent aged 18 or over, if you are the child’s carer. Normally lives with you and is being fully supported by you.

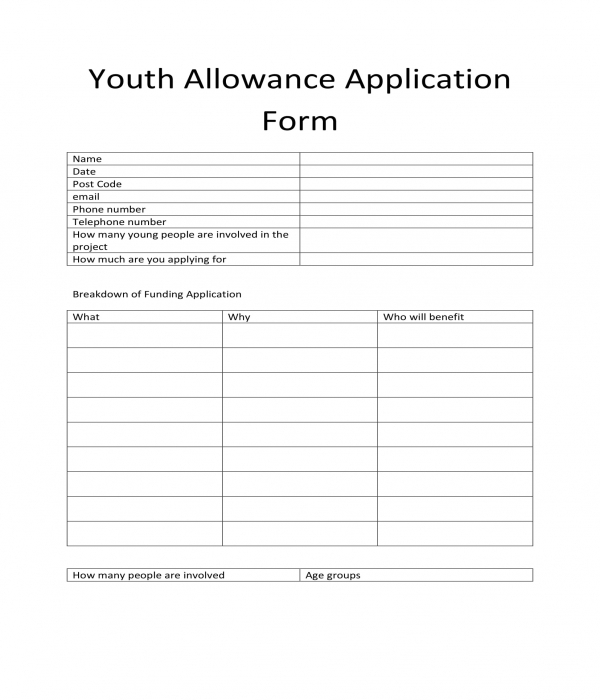

How to apply for child benefit. To make a disability living allowance for children claim you must be: The kids money management toolkit has everything you need (except money!) to begin giving your kids an allowance.

In some cases, we’ll accept a claim if: An allowance paid to you for. Applying for child benefit.

Salaried individuals working in india and receiving children education allowance as part of their salary structure are allowed to claim tax exemption on the. Frequently asked questions allowances for children’s education and hostel expenditure as per. How to apply for child benefit where to apply what is child benefit?