Heartwarming Tips About How To Build My Credit Fast

The first step to solving any problem is to acknowledge it fully.

How to build my credit fast. It's possible to recover from credit missteps. How long does it take to. Assess your debt & make a plan.

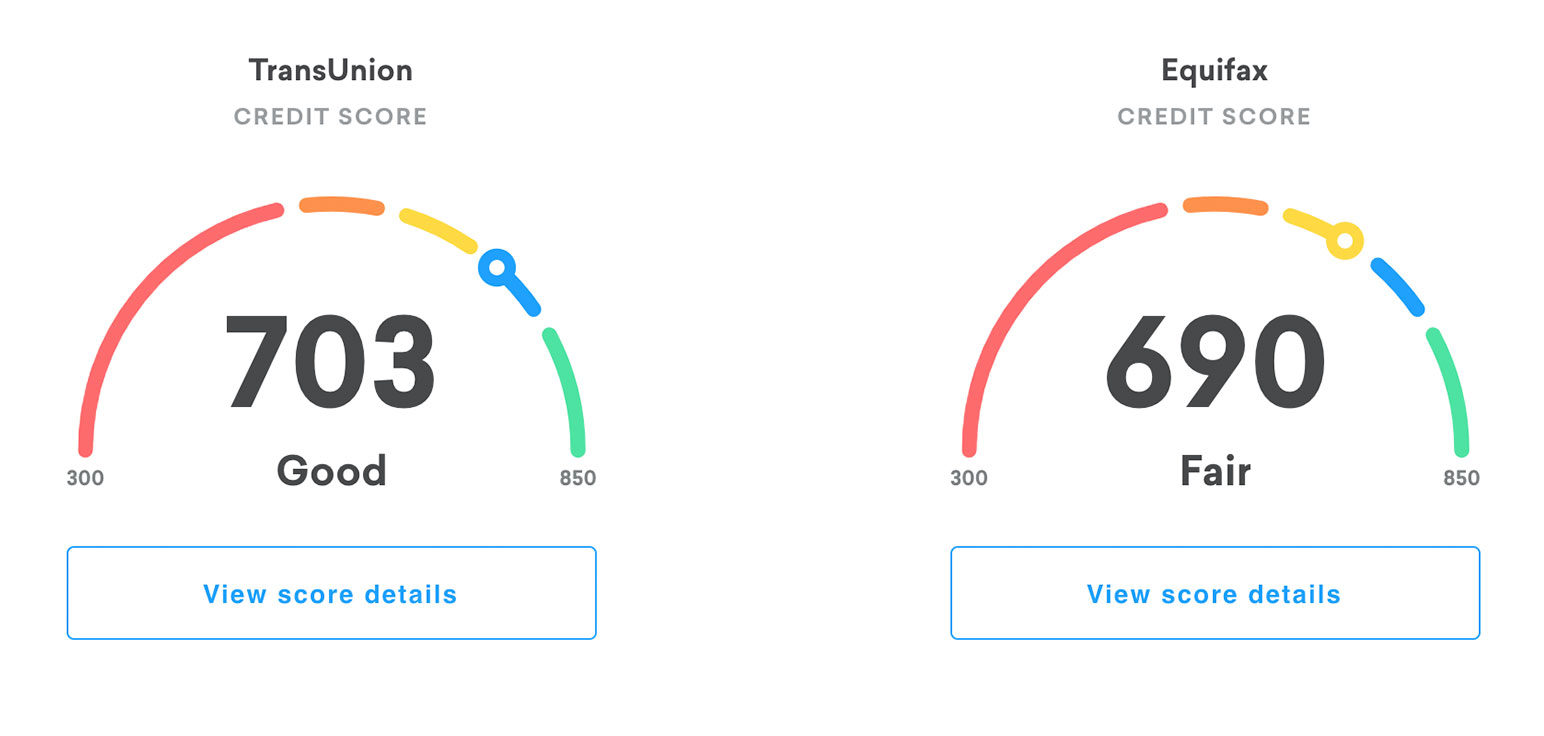

This helps rule out fraud and. And it’s the way you manage your credit cards that determines whether their credit score impact will be positive or negative. If your credit score is below average, there are ways to improve it — some provide quicker results than others.

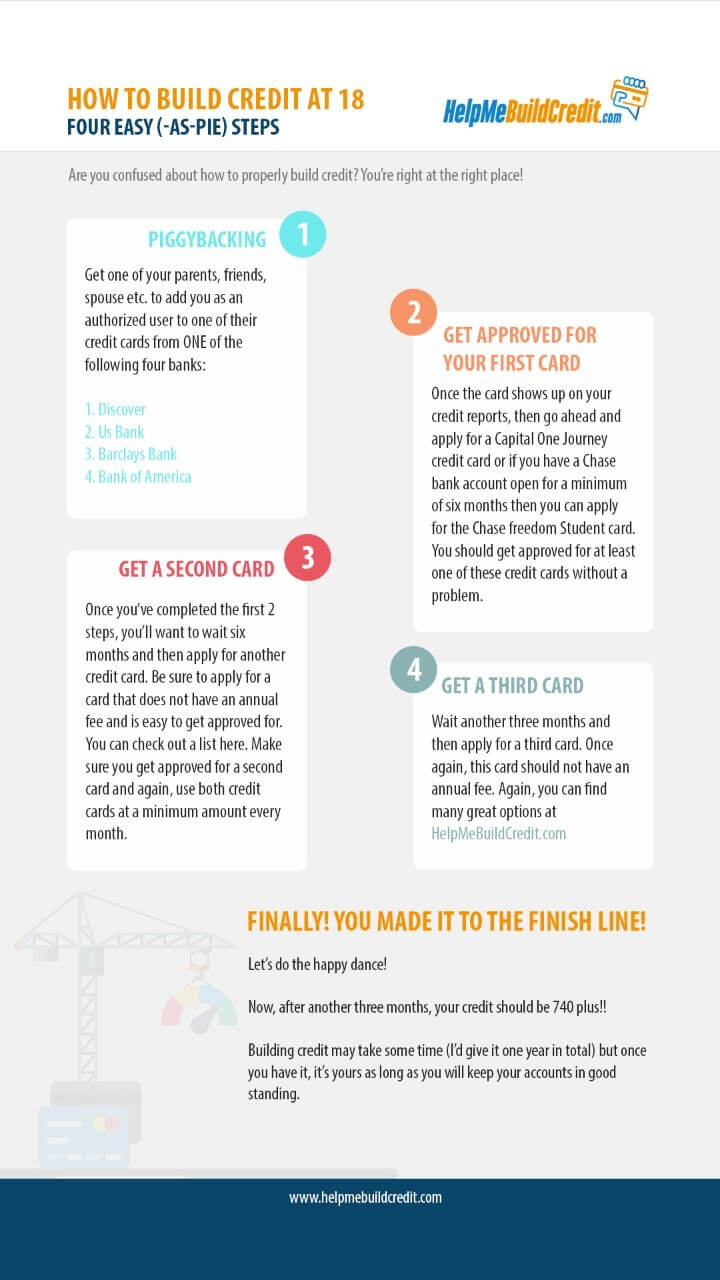

Experts share tips on how to quickly raise your. Of the three credit bureaus, experian offers the best user experience. To build credit fast, start by applying for a low balance credit card to make smaller purchases and using store credit cards for bigger purchases like furniture.

If your credit card limit is $1,000, you can spend $300. Here are three rules you’ll want to follow. Add an account to your credit reports.

Getting on the electoral roll benefits your credit score in two ways: If you’re starting from scratch, you’ll need at least six months of activity with a credit card or loan to receive your first credit scores. Find out how to dispute errors,.

Learn how to raise your fico® score instantly with experian boost™ and other tips to improve your credit score in four easy steps. Here’s how you can build good credit quickly, what credit scoring factors you should focus on and how to maintain a good credit score. Whether you’ve just begun building credit or you’re rebuilding after some setbacks, our guide below can help you build credit fast and level up your financial.

So if you have a good credit score and you want to maintain it, spending. It allows lenders to verify your identity. Being an authorized user won’t help you build credit as quickly as with your own card, but it’s certainly worthwhile.

Fix my credit score fast, best way to start credit, build credit history fast, start building credit, help me build my credit, how do you build. Tips to restore your credit include focusing on paying bills on time and keeping credit balances low. There’s a premium membership for $24.99 monthly that adds benefits like a credit score.

For those without credit, becoming an authorized user on a card with a long, positive credit history is the only fast way to build credit. If you spend more than 30% of your limit, that hurts your credit. Otherwise, it takes six months.

![How to Build Credit Fast [New StepbyStep Guide]](https://themillennialmoneywoman.com/wp-content/uploads/2020/10/how-to-build-your-credit-score-fast.png)

![How to Build Credit Fast [Infographic]](https://tradelinesupply.com/wp-content/uploads/2019/03/IMG_8140-4-1024x683.jpg)